Road Usage Charge

Consumer Group Accuses States of 'Punishing' Electric Vehicle Drivers

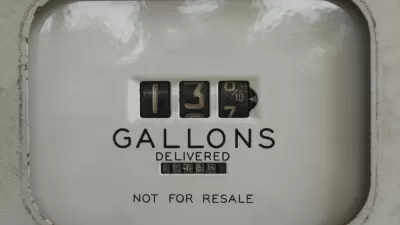

The advocacy division of Consumer Reports published a study to highlight the practice of what could soon be a majority of state governments: charging electric vehicle owners an additional registration fee to compensate for forgone fuel tax revenue.

Nevada to Embark on 7-Year Program to Record Mileage of Motorists

Nevada is one of 15 states in the Western Road Usage Charge Consortium that are considering a transition from funding their transportation budgets largely by taxing the gallons of fuel that vehicles burn to charging drivers for miles driven.

Washington State to Decide on Transition From Gas Tax to Road Usage Charge

Having completed a pilot program last year, the Washington State Transportation Commission will hear a report in October and vote in December on phasing out its 49.4 cents per gallon gas tax, fourth highest in the nation but not indexed to inflation.

The High, Regressive Costs Imposed by Electric Vehicles

Two UC Berkeley economists evaluated whether to charge electric vehicles a mileage fee since they pay no fuel taxes. A study from the Mineta Institute evaluated the impact of new EV registration fees and increased fuel taxes in California.

Federal Lawmakers Target Electric Vehicles in Transportation Reauthorization

How will motorists who don't pay gas taxes fund road upkeep? That's one of the questions that the Senate Environment & Public Works Committee hopes to answer this summer as they work to reauthorize the FAST Act before it expires on Sept. 30, 2020.

Reducing Transportation Emissions in the United Kingdom to Net Zero by 2050

Late last month, the UK became the first country to commit to a legally-binding target of achieving net-zero emissions by 2050. A new academic research group recommends reduced auto ownership, regardless of how they are powered, to meet the target.

Seven State DOTs Awarded $10 Million to Study Gas Tax Alternatives

When transportation spending was last reauthorized, rather than hike the gas tax to maintain current spending, Congress diverted general fund revenue. A program to study alternative revenue options was created so states could launch pilot projects.

Mileage Fee or Annual Fee for Electric Vehicles?

What's the best way to ensure that electric vehicle drivers pay to maintain the roads they drive on, considering they don't pay fuel taxes? A new report from the UC Davis Institute of Transportation Studies was sent to the California legislature.

Vehicle Miles Traveled Fee Becomes Debate Issue in Illinois Gubernatorial Race

Republican Gov. Bruce Rauner might as well have accused his Democratic opponent of wanting to hike the gas tax. J.B. Pritzker denies he plans to introduce a VMT fee but admits that he's open to all ideas to raise revenue to maintain infrastructure.

Federal Gas Tax Legislation Would Also Tax Bikes, EVs, and Transit

Rep. Bill Shuster, who chairs the House Transportation and Infrastructure Committee, wants to hike gas and diesel taxes by 15 and 20 cents per gallon, respectively, add two new user fees on bicycles and electric vehicles, and test VMT fees.

Road Usage Charge at Least 10 Years Away

Pilot programs are not the real thing, warned Michael Lewis, executive director of the Colorado Department of Transportation, testifying at a House transportation subcommittee on March 7. Colorado completed a successful four-month pilot last April.

The Slow Transition from Gas Taxes to Mileage Fees

Oregon was the first to conduct a pilot program in 2006, followed by California and Colorado last year. With financial backing from the U.S. DOT, at least four more states are exploring charging by the mile driven rather than the fuel burned.

Movement Toward Mileage Fee Gains Momentum in U.K. with Truck Fee

British trucker calls for a level playing field with 'continental trucks' that may pay no diesel duty is one impetus for the vehicle miles traveled fee that would also consider emissions. The Transport Department stresses it would not apply to cars.

Colorado DOT Issues Final Report on Road Usage Charge Pilot Program

Most of the 150 volunteers who participated in the 4-month program were pleased. Simulated invoices charged for vehicle-miles traveled after gas taxes paid were credited. Three technologies, including one with GPS, were available to record mileage.

California to Explore Next Steps in Converting From Gas Tax to Road Charge

A summary report of California's 9-month pilot program to test the use of a mileage charge to replace the gas tax to fund road infrastructure has been released. Next steps include exploring available technology to implement the road charge.

East Coast Prepares to Launch Road Usage Charge 'Mini' Pilot

Delaware and Pennsylvania will join a small, select number of western states that have explored technology to charge drivers by the miles they drive, not the fuel they burn, to fill their transportation budgets in lieu of fuel taxes.

Oregon's $3 Billion Transportation Funding Legislation Has a Tax for Almost Everyone

The package, which doesn't tax walking and running shoes, went to the legislature on June 30. It includes a ten cents per gallon gas tax, a 0.10 percent payroll tax, a $15 tax on new bikes costing at least $200, and a potential toll on I–205.

Gas Tax Increases Have Their Limits

Even if newly revised transportation legislation supported by Gov. Jerry Brown and Democratic leaders to raise fuel taxes and fees should pass into law, the funding mechanism may not prove sustainable in the long term.

Transportation Sales Tax Advances in Colorado Legislature

A bill to ask voters in November to increase the state sales tax by 0.62 percent to fund transportation projects passed its first House committee March 22 on a partisan vote, with Democrats in support and Republican opposed.

Electric Vehicle Fees: Where's the Controversy?

Some may find it silly to get worked up over an annual fee of about $100 to pay for road maintenance when electric vehicle purchasers receive a $7,500 federal tax credit, on top of generous state perks, but electric vehicle supporters object to them.

Pagination

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Caltrans

Smith Gee Studio

Institute for Housing and Urban Development Studies (IHS)

City of Grandview

Harvard GSD Executive Education

Toledo-Lucas County Plan Commissions

Salt Lake City

NYU Wagner Graduate School of Public Service