Regressive Taxes

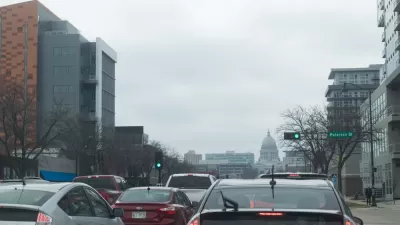

Madison Common Council Narrowly Approves Unpopular $40 Wheel Tax

Despite major opposition by residents, the Madison Common Council approved a $40 motor vehicle registration fee (aka 'wheel tax') on an 11-8 vote on Oct. 29 to help fund the city's new East-West Bus Rapid Transit system.

Sales Tax to Fund Water Projects Extended in Las Vegas Region

The Clark County Commission is extending a sales tax, created in 1998, which could have drawn to a close after raising $2.3 billion or the year 2025, whichever came first. The tax will remain in place indefinitely.

If Road Pricing Is Inherently Unfair and Regressive...

Road pricing has its faults as a revenue measure, but it needs to be compared to ten elements of the current system of paying for transportation, including hidden subsidies, says Joe Cortright, an urban economist with Portland-based City Observatory.

Equity Considerations Delay Congestion Pricing in Los Angeles

After discussing a staff report on road pricing at their Jan. 24 meeting, Los Angeles County Metropolitan Transportation Authority directors paused to weigh the equity implications of charging motorists to drive on roads.

Transit Agency Chief to Propose Congestion Pricing for Los Angeles

Los Angeles Metro CEO Phil Washington will recommend to his board next Thursday that they pursue a congestion pricing program to reduce traffic congestion, improve transit, and subsidize transit fares in Los Angeles in time for the 2028 Olympics.

President Macron Acquiesces to Yellow Vests' Demands on Fuel Tax Hike

Despite statements to the contrary just a week ago, Macron reversed position and caved to the demonstrators' demands that upcoming fuel tax hikes be suspended.

A Progressive Gas Tax?

One of the criticisms of gas taxes is that it is regressive, i.e., everyone pays the same per-gallon price. A Mississippi legislator has a solution: Eliminate the income tax on the lowest income bracket in exchange for hiking the gas tax 12-cents.

Pennsylvania Voters Could Eliminate Property Taxes

A measure on the Pennsylvania statewide ballot in next Tuesday's election would change the state's constitution to allow local jurisdictions the ability to eliminate property taxes.

300,000 Michigan Drivers' Debt Forgiven

Michigan to grant amnesty to 300,000 drivers whose licenses were taken from them because they were too poor to pay the "Driver Responsibility Fee."

Congestion Pricing Could Be Fairer Than the Status Quo

A timely debate, as New York City debates a congestion pricing scheme proposed by Gov. Andrew Cuomo, and California looks for ways to reduce emissions from transportation.

Op-Ed: Highway Tolling Can Have Multiple Benefits

The editorial board of the Toronto Star picks a side in the policy debate over highway tolling.

Parcel Tax Measure Would Fund Climate Adaptation in Bay Area by Restoring Wetlands

Next month, along with picking presidential, U.S. Senate and legislative candidates, and local ballot measures in a primary election, voters in the Bay Area will also determine the outcome of the first regionwide measure in Bay Area history.

Broward County, Florida Advances One-Cent Transportation Sales Tax

A one-cent transportation sales tax took a major step forward to being placed on the Broward County November 2016 ballot with the 7-1 approval of the Broward County Commission. It now goes to the Broward County Metropolitan Planning Organization.

How High is Too High for Transportation Sales Taxes?

Sales taxes are regressive, but unlike the gas tax, they bear no relationship to transportation. Should a November transportation ballot measure pass, sales taxes in three cities in the county of Los Angeles would exceed 10 percent.

Ten States Could Hike Gas Taxes this Year

With gas prices the lowest since 2009, ten state legislatures and governors consider raising state gas taxes, though many are accompanied by fiscally questionable tax shifts. Some tried and failed last year. All of the proposed increases are modest.

Auto Repairs From Potholes Got You Down? You Are Not Alone

A new report from the AAA indicates that American motorists encounter damage from potholes three times a year, with each incident costing an average $300 to repair. Middle and working class drivers feel the pinch disproportionately.

Are Land Use Policies Mostly Hurting the Poor?

In a new paper, researchers find that land use regulations in cities have effectively created a "zoning tax," which primarily impacts the poor and renting class.

Gas Tax Hike Showdown Headed to Nebraska

Strong leadership from the governor may be the most important factor in passing state gas tax increases. But what happens when the governor opposes increasing the gas tax and the legislature supports it? Nebraska is about to find out.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Caltrans

Smith Gee Studio

Institute for Housing and Urban Development Studies (IHS)

City of Grandview

Harvard GSD Executive Education

Toledo-Lucas County Plan Commissions

Salt Lake City

NYU Wagner Graduate School of Public Service