Fifty years of the Fair Housing Act hasn't been enough to stop banks and mortgage lenders from discriminating against people of color. Some bad actors are worse than others, though the whole industry in the aggregate is hardly free from indictment.

The Center for Investigative Reporting's "Reveal" platform released a bombshell report this week that finds evidence of mortgage lenders denying home loans to people of color at higher rates than for white people.

According to an article sharing news of the study, nearly two-thirds of mortgage lenders rejected people of color at higher rates, but there were a few extreme examples. The article lists the worst offenders as TD Bank and Capital One. "African American and Latino borrowers are more likely to get turned down by TD Bank than by any other major mortgage lender," according to the article. "The bank turned down 54 percent of black homebuyers and 45 percent of Latino homebuyers, more than three times the industry averages," write Aaron Glantz, Emmanuel Martinez, and Jennifer Gollan.

The article notes the rise of mortgage lenders since the Great Recession—unlike banks, mortgage lenders "are not required to follow Community Reinvestment Act rules to lend to low-income borrowers and in blighted communities." That lack of regulation creates lenders like Ruoff Home Mortgage, which "made 92 percent of its 5,300 conventional home loans to whites in 2015 and 2016" despite operating in a city with a large African-American community. The article includes more examples of banks taking advantage of loopholes to avoid loaning to people of color or to avoid the appearance of discrimination.

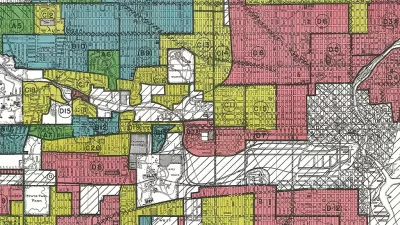

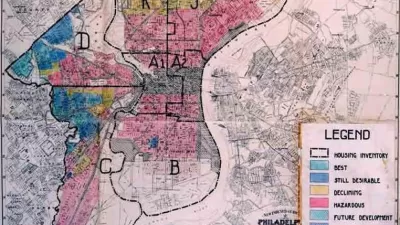

In addition to the article calling out specific banks and mortgage lenders for discriminatory practices, Glantz and Martinez also author the full report, titled "Kept Out." The report includes interactive infographics, testimonials, more explanation of discriminatory practices among banks and lenders, and a case study from Philadelphia.

FULL STORY: 8 lenders that aren’t serving people of color for home loans

Alabama: Trump Terminates Settlements for Black Communities Harmed By Raw Sewage

Trump deemed the landmark civil rights agreement “illegal DEI and environmental justice policy.”

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

The 120 Year Old Tiny Home Villages That Sheltered San Francisco’s Earthquake Refugees

More than a century ago, San Francisco mobilized to house thousands of residents displaced by the 1906 earthquake. Could their strategy offer a model for the present?

In Both Crashes and Crime, Public Transportation is Far Safer than Driving

Contrary to popular assumptions, public transportation has far lower crash and crime rates than automobile travel. For safer communities, improve and encourage transit travel.

Report: Zoning Reforms Should Complement Nashville’s Ambitious Transit Plan

Without reform, restrictive zoning codes will limit the impact of the city’s planned transit expansion and could exclude some of the residents who depend on transit the most.

Judge Orders Release of Frozen IRA, IIJA Funding

The decision is a victory for environmental groups who charged that freezing funds for critical infrastructure and disaster response programs caused “real and irreparable harm” to communities.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Clanton & Associates, Inc.

Jessamine County Fiscal Court

Institute for Housing and Urban Development Studies (IHS)

City of Grandview

Harvard GSD Executive Education

Toledo-Lucas County Plan Commissions

Salt Lake City

NYU Wagner Graduate School of Public Service