While the low income housing tax credit was retained, banks will be much less willing to purchase them due to their reduced corporate tax rate. That's just one way H.R. 1 will exacerbate divisions between the rich and poor in America's cities.

In her Big City column in The New York Times on Dec. 22, Ginia Bellafante focuses on how H.R. 1: Tax Cuts and Jobs Act, signed by President Trump the same day, will increase social inequality, particularly in cities. With tax cuts concentrated for the wealthy and corporations at the expense of adding $1.5 trillion to the national debt over ten years, the Republican controlled Congress will "push further measures of austerity — to provide the excuse to reduce federal funding for social programs on which cities rely," she writes.

While Bellafante's focus is on New York City, the points she and the experts make apply to most urban centers.

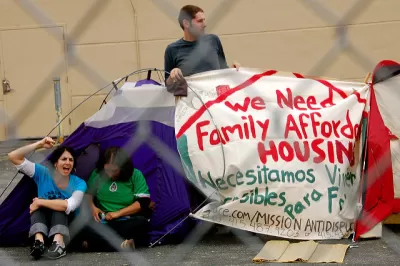

One impact will be on the construction of affordable housing due to the corporate tax reduction to 21 percent and how it impacts use of low-income housing tax credits.

Bellafante looks beyond the fact that this important tax credit, along with other important tax credits noted in a recent post based on an American Planning Association analysis, including the New Markets Tax Credit, a modified Historic Tax Credit, and tax-exempt private activity bonds, were retained in H.R.1.

Through the national Community Re-Investment Act, passed in the 1970s to address discrimination in lending, any bank receiving federal insurance must make sure it offers credit to a broad span of communities. To comply, banks became the largest purchaser of low-income housing tax credits in New York City. These credits are the instrument through which affordable housing is largely paid for.

But the reduction of the corporate tax rate to 21 percent means that there is now less of an incentive for banks to reduce their tax liability using these credits. They’ll still invest, but they’ll invest less money — in fact, this has already been happening in anticipation of the lowered corporate tax rate.

“It’s nothing short of chaos,’’ said Aaron Koffman, principal at Hudson Companies, a major developer of affordable housing in New York.

One area where the bill's impact will be less than some expect will be to act as an incentive for leaving New York City. See: "What the Tax Plan Means for New Yorkers" [pdf].

Studies that have examined the flight question have concluded that people don’t typically move from one state to another simply to avoid certain taxes.

However, the impact could be greater in the suburbs due to the new limit of deducting $10,000 in state and local taxes and property taxes.

In New York City, property tax bills that exceed $10,000 make up only 22.7 percent of households; on Long Island the figure climbs to 46.5 percent.

Education is the final urban issue the column looks at, specifically the new federal exemption of up to $10,000 each year for private-school tuition that is projected to reduce as much as $3 billion to New York's income tax base.

FULL STORY: Life, Death and Taxes in Inequality City

Alabama: Trump Terminates Settlements for Black Communities Harmed By Raw Sewage

Trump deemed the landmark civil rights agreement “illegal DEI and environmental justice policy.”

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

The 120 Year Old Tiny Home Villages That Sheltered San Francisco’s Earthquake Refugees

More than a century ago, San Francisco mobilized to house thousands of residents displaced by the 1906 earthquake. Could their strategy offer a model for the present?

Ken Jennings Launches Transit Web Series

The Jeopardy champ wants you to ride public transit.

BLM To Rescind Public Lands Rule

The change will downgrade conservation, once again putting federal land at risk for mining and other extractive uses.

Indy Neighborhood Group Builds Temporary Multi-Use Path

Community members, aided in part by funding from the city, repurposed a vehicle lane to create a protected bike and pedestrian path for the summer season.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Clanton & Associates, Inc.

Jessamine County Fiscal Court

Institute for Housing and Urban Development Studies (IHS)

City of Grandview

Harvard GSD Executive Education

Toledo-Lucas County Plan Commissions

Salt Lake City

NYU Wagner Graduate School of Public Service