A summary report of California's 9-month pilot program to test the use of a mileage charge to replace the gas tax to fund road infrastructure has been released. Next steps include exploring available technology to implement the road charge.

Notwithstanding November's historic 12-cents gas tax hike, the first increase in 23 years, California is exploring the option of transitioning from fuel taxes towards a vehicle-miles-traveled (VMT) fee to pay for it road needs, directed by legislation passed in 2014. Having completed a 9-month pilot program in March, the California State Transportation Agency (CalSTA) released an 88-page, "California Road Charge Pilot Program — Summary Report 2017" [pdf] on the pilot and next steps.

"Acknowledging the long term viability of the gas tax, the California Legislature and Governor Brown demonstrated the foresight to investigate a sustainable transportation funding mechanism, known as a road charge, with the passage of Senate Bill 1077 (Statutes of 2014, DeSaulnier)," states the introduction.

"[T]he report contemplates next steps toward additional research and the potential adoption of an operational road charge program," states CalSTA Director Brian P. Kelly in the Dec. 1 letter to the legislature, California Transportation Commission, and members of the Road Charge Technical Advisory Committee accompanying the final report.

I believe this pilot program accomplished the objectives you sought to achieve and provides valuable information that will prove helpful in assessing whether to seek adoption of a road charge mandate in the future as an important long-term funding mechanism for California's highway system. [Italics added].

Change in technology and reporting system anticipated

The pilot program, which began in July 2016, used similar technology to the Oregon program (known as OReGO). "Most volunteers used a device plugged into the vehicle’s data port that relied on wireless technology to transmit mileage information to a state contractor," reports Tony Bizjak for The Sacramento Bee on Dec. 8. "The state then sent each driver a simulated monthly invoice, and drivers sent in online mock payments."

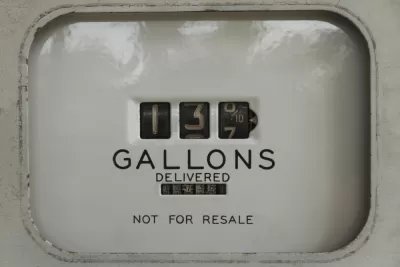

While the pilot went well, CalSTA wants to explore different reporting technology that would also simplify payments, similar to what is now used at gas stations.

"Caltrans Deputy Director Carrie Pourvahidi said the state will send out a request early next year to technology companies for ideas on a simple communication system at gas stations or electric charging stations that can instantly tell how many miles the car has driven," adds Bizjak.

“It’d be point-of-sale technology,” she said. “We’re looking for something so simple that there is nothing (the driver) has to do.”

If the state finds technology that works, it will apply for a federal highway grant to explore how to set up a statewide system. Other states have been looking into switching to a per-mile road tax, but California appears to be the first to look at point-of-purchase technology in recent years, Pourvahidi said.

VMT fee or Gas tax or + Electric Vehicle (EV) fee?

Of course, legislators will have to be convinced to take these next steps. Having fought for many years to hike the gas tax and finally achieving success this year, resistence is already surfacing to going the VMT fee route, considering that the gas tax legislation, SB 1, includes automatic gas and diesel tax inflation adjustors.

One legislator not in need of convincing is state Senator Scott Wiener (D-San Francisco) who believes "when it comes to road taxes, it’s time to start looking at charging you by the mile rather than by the gallon," reports Phil Matier for KPIX 5, the Bay Area CBS affiliate, on Dec. 11. An excellent newscast video accompanies the article.

“If you own an older vehicle that is fueled by gas, you’re paying gas tax to maintain the roads. Someone who has an electric vehicle [EV] or a dramatically more fuel efficient vehicle is paying much less than you are. But they are still using the roads,” Wiener said.

We want to make sure that all cars are paying to maintain the roads,” Wiener said.

Taking an opposing view is Randy Rentschler, Director of Legislation & Public Affairs for the Metropolitan Transportation Commission, who "said one answer is to raise the gas tax and up the vehicle registration fee for electric cars."

“If you buy a small car that gets great fuel economy, we don’t get enough money to repair the roads … but the fact of the matter is people are buying trucks,” Rentschler said.

SB 1 adds a $100 EV annual registration fee in 2020 that, like the gas tax, has an automatic inflation adustor.

However, should potential legislation be introduced next year to ban sales of passenger vehicles with internal combustion engines by a future date be approved and signed by Gov. Jerry Brown, the state would have no alternative but to adopt an alternative to the gas tax.

Hat tip to Construction Dive.

FULL STORY: California looks at dumping gas tax for per-mile fee as cars use less fue

Alabama: Trump Terminates Settlements for Black Communities Harmed By Raw Sewage

Trump deemed the landmark civil rights agreement “illegal DEI and environmental justice policy.”

Study: Maui’s Plan to Convert Vacation Rentals to Long-Term Housing Could Cause Nearly $1 Billion Economic Loss

The plan would reduce visitor accommodation by 25% resulting in 1,900 jobs lost.

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

Waymo Gets Permission to Map SF’s Market Street

If allowed to operate on the traffic-restricted street, Waymo’s autonomous taxis would have a leg up over ride-hailing competitors — and counter the city’s efforts to grow bike and pedestrian on the thoroughfare.

Parklet Symposium Highlights the Success of Shared Spaces

Parklets got a boost during the Covid-19 pandemic, when the concept was translated to outdoor dining programs that offered restaurants a lifeline during the shutdown.

Federal Homelessness Agency Places Entire Staff on Leave

The U.S. Interagency Council on Homelessness is the only federal agency dedicated to preventing and ending homelessness.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Caltrans

Smith Gee Studio

Institute for Housing and Urban Development Studies (IHS)

City of Grandview

Harvard GSD Executive Education

Toledo-Lucas County Plan Commissions

Salt Lake City

NYU Wagner Graduate School of Public Service