The California Transportation Commission met the initial deadline specified in 2021 state legislation requiring the state to perform a fully operational pilot program where participants will pay for the miles they drive.

Unlike the federal mileage fee pilot program authorized by the 2021 Infrastructure Jobs and Investment Act, a committee under the state Transportation Commission met the initial deadline specified in state legislation that also passed in 2021 requiring the California State Transportation Agency to conduct a second road usage charge pilot program “as an alternative to the gas tax system.”

“The Road Usage Charge Technical Advisory Committee shall, by no later than July 1, 2023, make recommendations to the Transportation Agency on the design of the pilot program to test revenue collection, including the group of vehicles to participate in the pilot,” states Senate Bill 399 authored by Sen. Scott Wiener (D-San Francisco) and signed into law by Gov. Gavin Newsom on Sept. 24, 2021.

“With our transition to more fuel efficient vehicles — and ultimately away from carbon-fueled vehicles entirely — gas tax revenue will decline and eventually end,” wrote Wiener (via Planetizen) on June 1, 2021.

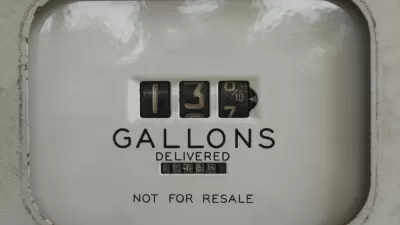

Unlike the first pilot conducted in 2016, participants will be required to pay the actual “fee per-mile traveled” for the pilot. Among the key recommendations in the 33-page Road Charge Pilot Design Recommendations (SB 339) report prepared by CDM Smith, Inc., the source article [pdf] for this post, released June 29:

- Establish a flat per-mile rate cohort, use a road charge rate of 2.5 cents per-mile for light-duty vehicles, higher for medium- and heavy-duty vehicles,

- Offer exemptions for out-of-state miles driven.

The legislation requires a second cohort in the pilot program where the participants will be charged a variable 'fee per-mile traveled' based on the fuel efficiency of their vehicle. These two cohorts are central to the program. [Italics are part of the report]:

SB 339 requires the California State Transportation Agency [CalSTA] to discuss in its final report the relative effectiveness of the two rate-setting methodologies in aligning “with the state’s climate, air quality, (and) zero-emissions vehicle… goals.”

SB 339 also requires CalSTA to discuss in its final report the effectiveness of the two rate-setting methodologies “in ensuring sustainable funding for transportation.”

Focus on revenue-collection system

In reading the report and contrasting it with the 2017 final report [pdf] after the 2016 pilot was concluded (also posted here), it's clear that the reporting and payment scheme has changed drastically. CalSTA appeared to be hoping for a "pay-at-the pump option for a road charge system,” as the 2017 report noted.

While the mileage reporting methods tested in the Road Charge Pilot Program are all feasible, they cannot compete with the simplicity, cost effectiveness, and public acceptance of the current gas tax collection process.

“It’d be point-of-sale technology,” said then-Caltrans Deputy Director Carrie Pourvahidi (via Planetizen) on December 8, 2017. “We’re looking for something so simple that there is nothing (the driver) has to do.”

If only that was possible. To further complicate revenue collection, participants will "receive a credit or a refund for fuel taxes or electric vehicle fees,” according to the legislation.

Timeline

According to a July 18 email from Lauren Prehoda with the Caltrans road charge program, the pilot will likely begin next year though a date hasn't been set. The next deadline is July 1, 2024 when CalSTA must “submit an interim report on the status of the pilot program” to the legislature. The final report is due “no later than December 31, 2026.”

In fact, the authorizing legislation for the pilot program ends on January 1, 2027. New legislation would have to be written to advance the road usage charge beyond that date, illustrating the lengthy process required to transition to “an alternative to the gas tax system.”

FULL STORY: Senate Bill 339 Road Charge Pilot Design Recommendations Report [pdf]

Study: Maui’s Plan to Convert Vacation Rentals to Long-Term Housing Could Cause Nearly $1 Billion Economic Loss

The plan would reduce visitor accommodation by 25,% resulting in 1,900 jobs lost.

North Texas Transit Leaders Tout Benefits of TOD for Growing Region

At a summit focused on transit-oriented development, policymakers discussed how North Texas’ expanded light rail system can serve as a tool for economic growth.

Why Should We Subsidize Public Transportation?

Many public transit agencies face financial stress due to rising costs, declining fare revenue, and declining subsidies. Transit advocates must provide a strong business case for increasing public transit funding.

How to Make US Trains Faster

Changes to boarding platforms and a switch to electric trains could improve U.S. passenger rail service without the added cost of high-speed rail.

Columbia’s Revitalized ‘Loop’ Is a Hub for Local Entrepreneurs

A focus on small businesses is helping a commercial corridor in Columbia, Missouri thrive.

Invasive Insect Threatens Minnesota’s Ash Forests

The Emerald Ash Borer is a rapidly spreading invasive pest threatening Minnesota’s ash trees, and homeowners are encouraged to plant diverse replacement species, avoid moving ash firewood, and monitor for signs of infestation.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Ascent Environmental

Borough of Carlisle

Institute for Housing and Urban Development Studies (IHS)

City of Grandview

Harvard GSD Executive Education

Toledo-Lucas County Plan Commissions

Salt Lake City

NYU Wagner Graduate School of Public Service