On August 2nd, a new 15 percent tax on real estate deals with foreign buyers went into effect. The goal was to cool the hyperactive housing market, but the implementation has caught many by surprise.

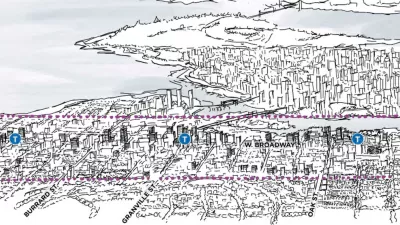

Reports of collapsing real estate deals and reactions of "disbelief" among buyers and sellers are the initial results of the new 15 percent tax on foreign real estate investments that went into effect on August 2nd. As Vancouver struggles with a housing market that like many cities has seen housing prices climb beyond normal affordability levels, the tax was seen as a way to preserve affordable housing for full-time residents of the city by reducing "speculative investing" by foreign investors. Yvette Brend of CBC News reports that the impacts of the new tax have been swift.

On a half-million dollar deal the tax represents $80,000 to $90,000, said Jonathan Cooper, vice president at Macdonald Real Estate Group in an interview with CBC's The Early Edition.

...

He described an immigrating family who recently bought a home on Bowen Island for $750,000 in time for their daughter to attend UBC, only to face an extra $100,000 to pay.

"It was a burden for them. This isn't the kind of family that has an extra $100 thousand dollars just lying around," he said.

Some critics of the tax have complained that deals struck before August 2nd were not grandfathered in under the implementation plan. Others view the tax as a violation of NAFTA, "which prohibits governments from imposing policies that punish foreigners," and promise to challenge the new tax in court.

FULL STORY: Thousands of Metro Vancouver real estate deals caught by tax deadline

Study: Maui’s Plan to Convert Vacation Rentals to Long-Term Housing Could Cause Nearly $1 Billion Economic Loss

The plan would reduce visitor accommodation by 25,% resulting in 1,900 jobs lost.

North Texas Transit Leaders Tout Benefits of TOD for Growing Region

At a summit focused on transit-oriented development, policymakers discussed how North Texas’ expanded light rail system can serve as a tool for economic growth.

Why Should We Subsidize Public Transportation?

Many public transit agencies face financial stress due to rising costs, declining fare revenue, and declining subsidies. Transit advocates must provide a strong business case for increasing public transit funding.

How to Make US Trains Faster

Changes to boarding platforms and a switch to electric trains could improve U.S. passenger rail service without the added cost of high-speed rail.

Columbia’s Revitalized ‘Loop’ Is a Hub for Local Entrepreneurs

A focus on small businesses is helping a commercial corridor in Columbia, Missouri thrive.

Invasive Insect Threatens Minnesota’s Ash Forests

The Emerald Ash Borer is a rapidly spreading invasive pest threatening Minnesota’s ash trees, and homeowners are encouraged to plant diverse replacement species, avoid moving ash firewood, and monitor for signs of infestation.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

City of Santa Clarita

Ascent Environmental

Institute for Housing and Urban Development Studies (IHS)

City of Grandview

Harvard GSD Executive Education

Toledo-Lucas County Plan Commissions

Salt Lake City

NYU Wagner Graduate School of Public Service