Nearly 6 million Californians will receive $600 in economic stimulus checks as the state makes a plan to spend its surprise, massive budget surplus. $2.6 million for rent relief and $2 billion to pay utility bills are also planned.

"Buoyed by a historic influx of tax revenue, Gov. Gavin Newsom on Monday announced a massive expansion of a state economic stimulus plan," reports Scott Shafer.

"The announcement, framed by the governor as part of his 'California Comeback Plan,' is a major expansion of a stimulus package Newsom signed into law in February that sent one-time payments of $600 to nearly 6 million low-income Californians," adds Shafer.

"According to the California Department of Finance, households earning up to $75,000 in adjusted gross income will be eligible for the new round of stimulus checks, with an extra $500 for families with children."

The stimulus spending is made possible by a $75.7 billion budget surplus—a remarkable development for the state considering the dire alarms sounded about the potential for fiscal crisis at the state and local levels as a result of the pandemic. According to Shafer, the strength of the stock market, combined with federal stimulus spending through the American Rescue Plan, enabled the windfall.

There's also a surprising twist to this news about the state's big stimulus spending plans. Los Angeles Times reporter Liam Dillon amplified the news about an extra layer of significance about how this stimulus plan came to be, namely, anti-tax legislation approved by state voters in 1979.

Anyone following Newsom's plan to send $8b in stimulus payments to 2/3rds of Californians needs to understand he's essentially required to send money back to taxpayers due to a 1979 ballot measure mandating that real per person state government spending must be under 1979 levels https://t.co/WIfNAAiRg8

— Liam Dillon (@dillonliam) May 10, 2021

Shafer also offers an explanation: "The so-called 1979 Gann Limit, named for the Proposition 13-era anti-tax crusader Paul Gann, capped state spending at 1978-79 levels with adjustments for population growth and growth in personal income taxes. It was last triggered in 1986."

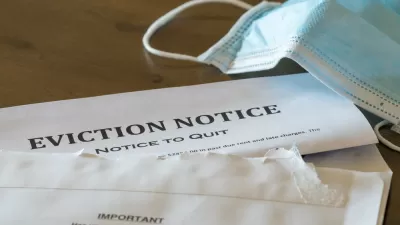

Perhaps buried by the big boost to the California Comeback Plan, Gov. Newsom on the same day announced a $2.6 billion plan to help renters pay for unpaid rent debt incurred during the pandemic—the source of a large amount of economic angst and the lingering potential to upend the economy.

NEW: CA is delivering immediate relief to renters through the largest renter assistance package in the COUNTRY:

$5.2 billion for renters to cover their back-rent AND their rent for several months into the future.

And $2 billion to help pay overdue water and utility bills.— Gavin Newsom (@GavinNewsom) May 10, 2021

According to Shafer, the state's sudden fiscal strength does not reflect a completely sound economy. The state's unemployment rate is higher than the national average, and there is obvious need for support for those struggling outside the corporate and capital realms that achieved during the pandemic.

The news about California's economic relief spending took an additional turn today, a day after the news about the direct payments and rent relief, as CalMatters reporters got the scoop about an impending announcement about additional spending to address the state of California's homelessness crisis.

BREAKING: @GavinNewsom will today propose investing $12 billion to address CA’s homelessness crisis.

- $8.75B for 46,000 homeless housing units/placements & affordable apartments

- $3.7B in homeless prevention and rental support

- $1.5B to clean up roadways & public spaces— Emily Hoeven (@emily_hoeven) May 11, 2021

Planetizen will update this story with more details on the proposed spending to address the state's homelessness crisis as it becomes available. Update: Julie Watson and Janie Har report on the plan to spend $12 billion of the state budget surplus to address homelessness. The article also includes details about the State's efforts to reduce risks for people experiencing homelessness during the pandemic.

FULL STORY: Flush With Cash, California Set to Send Billions in Rebates to Taxpayers

Study: Maui’s Plan to Convert Vacation Rentals to Long-Term Housing Could Cause Nearly $1 Billion Economic Loss

The plan would reduce visitor accommodation by 25,% resulting in 1,900 jobs lost.

North Texas Transit Leaders Tout Benefits of TOD for Growing Region

At a summit focused on transit-oriented development, policymakers discussed how North Texas’ expanded light rail system can serve as a tool for economic growth.

Why Should We Subsidize Public Transportation?

Many public transit agencies face financial stress due to rising costs, declining fare revenue, and declining subsidies. Transit advocates must provide a strong business case for increasing public transit funding.

How to Make US Trains Faster

Changes to boarding platforms and a switch to electric trains could improve U.S. passenger rail service without the added cost of high-speed rail.

Columbia’s Revitalized ‘Loop’ Is a Hub for Local Entrepreneurs

A focus on small businesses is helping a commercial corridor in Columbia, Missouri thrive.

Invasive Insect Threatens Minnesota’s Ash Forests

The Emerald Ash Borer is a rapidly spreading invasive pest threatening Minnesota’s ash trees, and homeowners are encouraged to plant diverse replacement species, avoid moving ash firewood, and monitor for signs of infestation.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Ascent Environmental

Borough of Carlisle

Institute for Housing and Urban Development Studies (IHS)

City of Grandview

Harvard GSD Executive Education

Toledo-Lucas County Plan Commissions

Salt Lake City

NYU Wagner Graduate School of Public Service