Housing affordability is too often seen as the way to stabilize and revitalize weak markets. Neighborhood planning consultants Charles Buki and Elizabeth Humphrey Schilling argue that interventions in weak markets must encourage investment by improving market confidence.

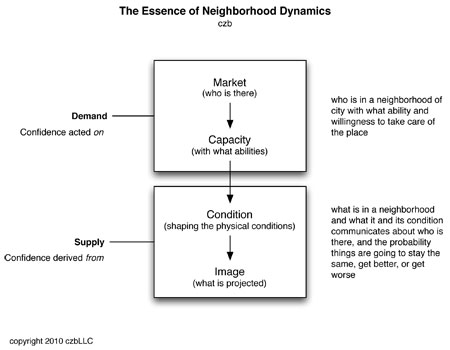

Previously, we made the case that focusing a zoom lens on weak markets - analyzing them at a finer resolution than public policy is otherwise willing or able to see - highlights the pivotal role of confidence in restoring market strength. Because neglect is contagious, and because the condition of one property can have a devastating impact on the values of homes around it, both the level of confidence and the capacity of individual householders is critical data and an important point of leverage for policy makers. Here we discuss a bit further the relationship between confidence and capacity as a way to discern what to do and what not to do when intervening in a weak market city.

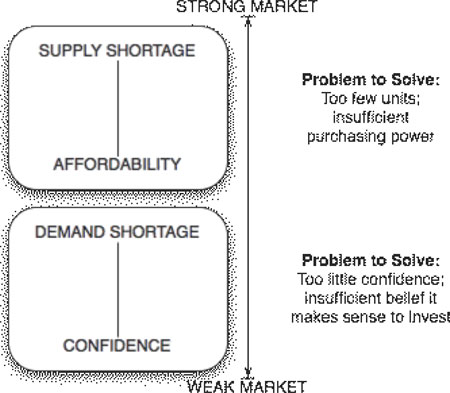

Weak markets are weak because people do not choose to live there; there is too little demand. If the goal is stabilization and revitalization, the structural problem to solve for in weak markets is confidence, not affordability. This point needs to be made again and again. To paraphrase Kevin Huffman of Teach for America, too few in our field are committed to more than the language of reform. Much of the community development has learned the words: "weak markets", "landbanking", "stabilization". What is needed now is to put them together so they aim at triggering structural change.

Weak markets are on a clear trajectory: population loss, falling demand, declining prices, reduced reinvestment, tired stocks, vacancy, abandonment, more population loss. Real weak market reform is aimed at reversing this, not using it as a new opportunity to cement the status quo. Just as we must acknowledge that our schools and education policies are failing poor kids in distressed communities, so too is it time to come to grips with the fact that our housing programs and policies continue to fail poor families and the neighborhoods they live in.

Real reform intervenes where structural change is possible. In weak markets, structural change hinges on a change in behavior - increased private investment - resulting from increased confidence. The operative aim of any intervention must be to invest in ways that generate enough confidence among neighbors to persuade them to follow suit.

The Paradox of Creeping Decline

Confidence is inversely related to affordability. As markets becomes less appealing, demand tapers off. Regardless of the reasons that markets become less desirable, their reduced attractiveness translates into reduced housing values. In other words, as desirability falls, affordability increases. This is an insight long known to community developers, of course: the most affordable places to live are those in the most trouble. Our collective aim in weak markets must be to turn this on its head. And we believe that the way to go is to use data-driven precision thinking that points to key parts of cities as the best places to intervene on the supply side, and to a surprising source of financial wherewithal on the demand side.

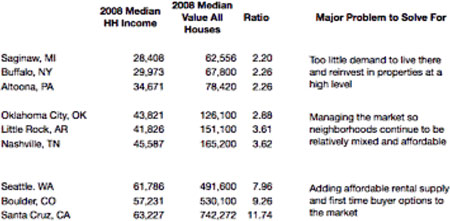

We think a good place to start in calibrating a weak market intervention is by thinking more about actual affordability. The benchmark for what is affordable is a housing cost-to-income ratio of about three to one. That is, a market where median housing costs are four times the median income is a market out of reach for many, and a market where the ratio is two-to-one is extremely affordable. A really overheated market like San Francisco will have ratios in excess of seven, or even higher. A market in the middle like Oklahoma City will have ratios of about three. Weak markets, by contrast, will often have ratios below three. We regard a market with housing cost to income ratios of between 2.7 - 3.3 to be stable and balanced. Much north of 4 and housing cost burdens for working families are a real problem. Much less than 2.5 and there will be vacancy, creeping abandonment, and other signs of real trouble. In markets like Camden or Gary where there is both a ratio near to above 3:1 as well as pervasive blight, poverty rates are usually above 35 percent. In those markets poverty becomes the problem to solve for and must not be confused with neighborhood revitalization.

These ratios are important, but what's more interesting is what happens on the way down, as 3-to-1 ratios slide towards 2-to-1. As fewer households choose to stay in a market, and leave, demand falls off. But incomes don't tend to fall quite so fast as housing prices except in those cases where one day the mill or mine is open and everyone is employed and the next it is shuttered and people are dropping their house keys in a box on the bank doorstep on their way out of town. Typically, housing values are flat or slightly off for decades, while incomes are somewhat more stable, especially as local economies in weak markets become more government-oriented.

When housing values fall over time, but faster than incomes have declined, this decreases the housing price-to-income ratio, and the difference, ironically, shows up in the form of excess dollars in the pockets of many households. People aren't feeling like they have extra money laying around, though, so much of the work in weak markets is to draw attention to this and the upside of reinvesting in their homes with the hope that minds begin to change.

One characteristic of our country's approach to markets in struggling economies is our mistaken tendency is to treat weak market places as nothing more than weak. We tend to think a weak market has no financial other capacity whatsoever. We think the problem is all about fixing deficits. But that is not necessarily true. When you look more closely at places like Buffalo and Detroit, what you find is that housing costs are so low relative to incomes that even after factoring in high home heating costs and transportation costs and high property and other taxes, the average household still has $30, $40, even $50 a month that would be spent on housing in any other market.

This difference is both an opportunity and, more importantly, a signpost: This money is indicative of the difference between a cohort's ability to pay on one hand, and willingness to pay on the other -- a signal pointing towards structural problems in the market that should be the focus of our field's work in such circumstances.

Let's take Tim and Mary Johnson. The Johnson family is in a very good position to buy the house they've had their eye on. Their annual income is $54,000, and the home on Windsor Avenue is priced at $52,000, which means that only 13.46% of their income will go towards housing each month. Instead of a housing payment of $1,456 that would be the case in a stronger market where that same house might sell for $125,000, the Johnson's payment turns out to be $606. In a stronger market, at least part of this "extra" $800 each month would likely go towards home maintenance and improvement, as the owners protect their investment and look to a good return. In a weak market, investing more in an asset that its owners believe will lose value over time makes no sense, and the money is diverted to other discretionary uses.

Even much smaller amounts add up to real money. A very down-on-its-luck Michigan town of just 20,000, with 7,000 households averaging an extra $42 a month not going for housing contains $3.3M a year in "withheld confidence in itself". A weak but still stronger western New York market of 30,000, averaging an extra $75 a month per household contains $9M a year in such withheld confidence.

This information is astonishing to local leaders, who are startled to find that the means to dig out is often right in front of them. It is not dependent on gifts from foundations, though these are essential. It is not coming down the pipe from Washington in subsidies from CDBG and HOME and, yes, now NSP2, too. It is there in the community itself.

It is there, but locked up in lack of confidence. The work, then, is figuring out why the average family won't spend $500 a year it can plainly afford to invest in its own home. What would it take to grow that family's confidence to the point where that investment makes sense?

Building Confidence, Encouraging Investment

Our most cost-effective work as community developers is thus to mobilize communities to see the upside of investing in themselves. We do not have to ask for much. Small amounts of withheld resources - just $40 a month - can have a lasting impact on the condition of a home. A new mailbox, porch light, and screen door make all the difference. They show that someone is home, and possibly that the light is on. Of course, very few homeowners look at this cash as "extra." The money is spent, frittered away in third car payments, trips to Atlantic City or the Sandusky Ferris Wheel or Wegman's sushi bar.

What can local governments, community developers and foundations do to shake loose some of this spare change, and, even more importantly, the family's social capital on their block and in their community?

In a nutshell, all public and philanthropic activities have to be aimed at making things better where strength is already apparent, not less worse where things are pretty awful. Every public action must be engineered to grow confidence in the market and demonstrate that things are improving. Property owners in a weak market can sniff out anything that comes remotely close to justifying their own default behavior of disinvesting. If an intervention activity so much as smells like it might further weaken the market, observers will continue to pull back. Interventions must be designed with close attention to the market signals they send.

The rest of a confidence-building, investment-promoting strategy is straightforward:

1. Identify blocks with the highest probable return on investment.

These are the blocks where a few lower-quality properties appear to be affecting the values of a significant number of higher-quality properties. The number of residential structures with problems in a weak market always exceeds the amount of money available to fix them, so the flow of money that can be raised must be aimed at those houses on those blocks that matter most to market recovery.

2. Cross-reference with a block-by-block analysis of excess capacity.

In general owners have more excess capacity than renters, and middle-aged owners more capacity than young families. These blocks will be among the strongest middle market blocks in a weak market city, but are typically experiencing creeping blight and slow erosion of owner occupancy. These are sweet-spot blocks that almost always get overlooked by local government and by nonprofits because there is no apparent problem. Yet on closer examination, nearly all of those owning and living in these homes are salt-of-the-earth 40-hour-a-week working families who, though not poor, and not rich either. In a typical weak market city these families earn 75-100 percent of the area median income. Their blocks are slowly going downhill, they are seeing low-quality landlords creep onto their street, and these families have $500 a year they could apply towards their homes. Their disinclination to do so, even while they are mowing their yards and sweeping their walks, flows from frustrations with property taxes and a sense that the real problems in their town are on those really troubled blocks "over there". Coupled with local government and nonprofit tendencies to agree, and thus to tend to conditions "over there", these sweet-spot blocks - the ones that can make or break weak market recovery, are too often forgotten.

This intersection of most capacity and best return on investment creates a list of blocks where public investments could have the biggest impact, both by increasing surrounding values through the improvement of specific properties and by leveraging maximum private investment. In this case, the most effective public investments would be improvements to compromised homes even if they are not yet derelict, street and sidewalk repairs on blocks not yet distressed, and other incentives we typically think should be applied to blocks in worse condition. We do this not because the challenges faced on the most distressed blocks are of no importance, but because we have limited resources and these middle market blocks - these sweet spots blocks - are both the next ones to go and the ones we can turn around for a fraction of the cost. It's on these blocks where you rebuild the infrastructure of confidence.

3. Shape interventions on these blocks to encourage individual homeowner investment.

For instance, link individual investments to additional public expenditures in the neighborhood, or use private foundation grants to match individual investments. Marry these interventions to other efforts to stabilize the market and reinforce community standards, such as making code enforcement practices legible and predictable, gearing policing to disorder rather than primarily targeting hot-spots, placing caps on property tax increases, establishing city-wide rental property registration requirements, and establishing a moratorium on new housing for low-income families on bottom-of-the-market blocks.

These are not new tools. Every weak market has experimented with them, and failure is attributable not to the tool - whether landbanking, tax abatements, coordinated infrastructure upgrades, or even community organizing - but instead to the lack of genuine, baked-into-our-DNA understanding of markets: knowing that in a weak market the problem to solve for is too little demand and the currency that neighborhoods trade on is confidence. If by contrast we persist in seeing Buffalo and Rochester and Detroit and Youngstown and Pittsburgh as places where community development means affordable housing, then the quality of the tools we have - from good planning to creative financing - won't remedy the underlying structural problems such markets face.

It is useful to remember that weak markets are weak for reasons. They lack jobs people need, so people leave. Nonetheless, weak market cities eventually find their steady state, adjust (or maladjust) to a new economic reality, and remain overbuilt in profound ways. Amid this excess, it is a shortage instead that begs our attention: too little confidence. Too little confidence in the future to justify spending what many weak markets clearly possess: resources sufficient to upgrade properties and remind current residents that their community can be strong again.

Charles Buki and Elizabeth Humphrey Schilling work at czb, a neighborhood planning practice based in Alexandria, VA.

Manufactured Crisis: Losing the Nation’s Largest Source of Unsubsidized Affordable Housing

Manufactured housing communities have long been an affordable housing option for millions of people living in the U.S., but that affordability is disappearing rapidly. How did we get here?

Americans May Be Stuck — But Why?

Americans are moving a lot less than they once did, and that is a problem. While Yoni Applebaum, in his highly-publicized article Stuck, gets the reasons badly wrong, it's still important to ask: why are we moving so much less than before?

Using Old Oil and Gas Wells for Green Energy Storage

Penn State researchers have found that repurposing abandoned oil and gas wells for geothermal-assisted compressed-air energy storage can boost efficiency, reduce environmental risks, and support clean energy and job transitions.

Minneapolis Bans Rent-Setting Software

Four cities have enacted restrictions on algorithmic software that can inflate rent costs.

Oakland to Add 244 New EV Chargers

Oakland plans to launch its new charging network at eight locations by the end of 2025.

Jane Goodall Inspires with Message of Hope, Resilience, and Environmental Action

Speaking in Pasadena, Jane Goodall offered a hopeful and inspirational message, urging global compassion, environmental responsibility, and the power of individual action to shape a better future.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

City of Moreno Valley

Institute for Housing and Urban Development Studies (IHS)

City of Grandview

Harvard GSD Executive Education

Salt Lake City

NYU Wagner Graduate School of Public Service

City of Cambridge, Maryland